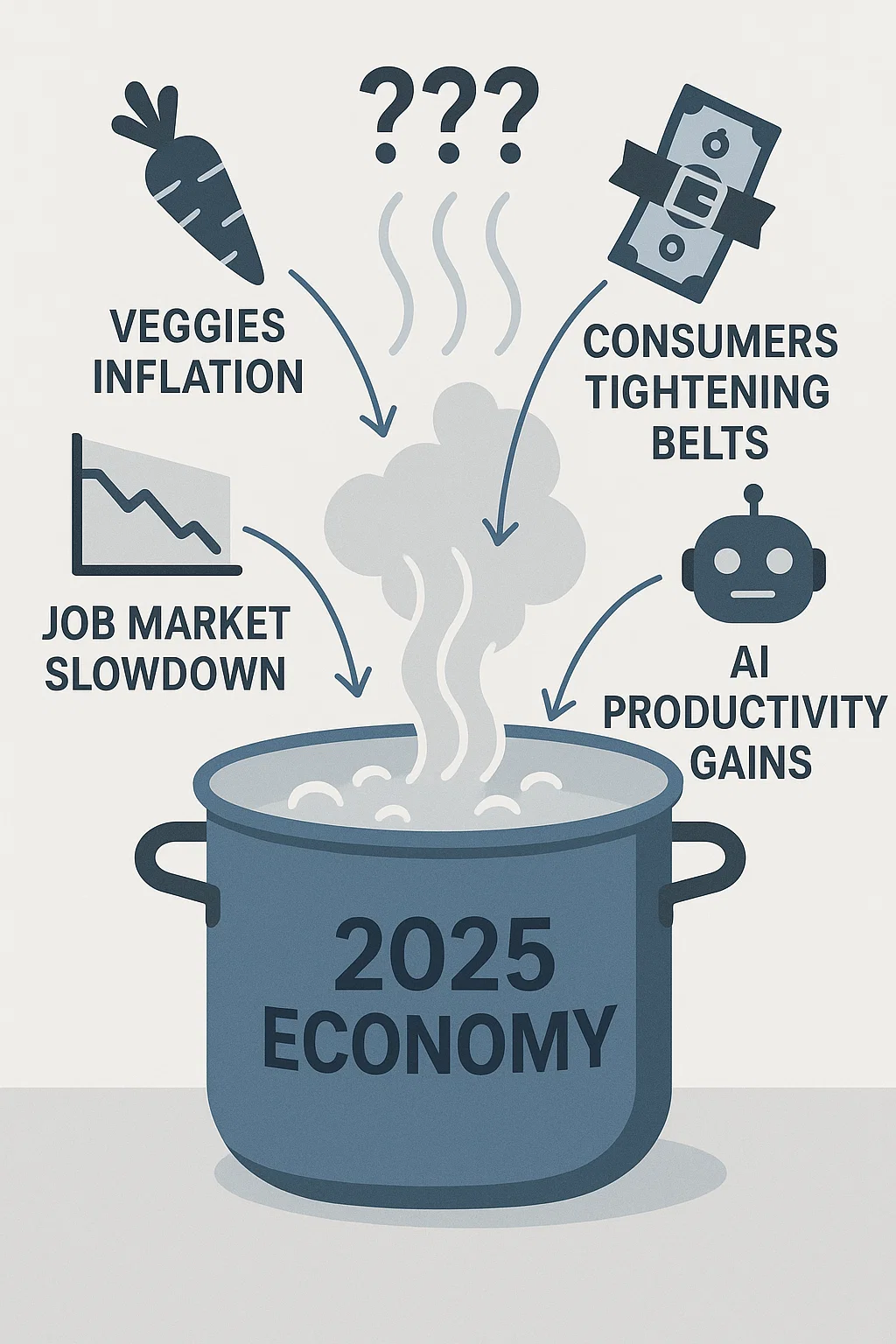

When Macrotrends Collide: Four Ingredients in Today’s Economic Boil

1. Inflation Hits the Basics

In July, wholesale vegetable prices surged nearly 40%, the steepest jump in decades. Axios and ABC News note tariffs and supply disruptions as major contributors, while farm labor shortages continue to squeeze harvests. What begins at the farm level quickly cascades through distributors, grocers, and ultimately into consumer wallets.

Implication: Firms in manufacturing, distribution, and food services must prepare for volatile input costs that can spike almost overnight. Strong supply chain and pricing strategies — including scenario planning, cost-to-serve analysis, and rapid response mechanisms — are critical to avoid margin shock.

2. Consumers Tighten Belts

Recent reporting from the Wall Street Journal shows households pulling back on both big-ticket purchases and everyday indulgences. Procter & Gamble highlighted that shoppers are visiting stores less frequently and relying more on stockpiled goods. Even middle-income families are shifting toward generics and promotions.

Implication: Value is being redefined. Pricing teams must sharpen their understanding of willingness to pay, trade-down behavior, and the thresholds at which loyalty breaks. In B2B markets, the parallel is tighter procurement scrutiny and harder negotiations.

3. Job Market Shows Signs of Softening

Reuters recently reported U.S. job openings at a 10-month low, with unemployed workers now outnumbering openings for the first time since the pandemic. The Federal Reserve’s Beige Book points to slower hiring, cautious consumer spending, and rising attention to automation.

Implication: A cooling labor market may temper wage growth, but it can also stall demand. Executives must be ready for more price sensitivity in negotiations and slower sales cycles — even as input costs remain unpredictable. This makes pricing strategies & tactics even more important.

4. AI Productivity Gains Begin to Reshape Workflows

Amid these headwinds, AI stands out as a potential tailwind. From forecasting to supply chain optimization, AI-driven productivity improvements are real, though adoption is uneven. Some firms are leaning aggressively into automation, while others are still experimenting at the edges.

Implication: Early movers can use AI to offset cost pressures and deliver efficiency gains that competitors cannot yet match. Pricing leaders, in particular, can use AI to refine segmentation, accelerate elasticity analysis, and respond faster to market shifts.

What happens when you mix these trends: inflation, consumer caution, labor softening, and AI productivity? The outcome is hard to predict. For executives, that uncertainty is itself the challenge.

At Chapel Hill Advisors, we help leaders prepare for volatility by:

Stress-testing pricing strategies against multiple scenarios

Building transparency and trust into value propositions

Embedding analytics and AI into decision-making frameworks

In times like these, there is no single recipe. But thoughtful strategy can turn a volatile stew into a source of competitive advantage.

Contact us to discuss how your organization can navigate these cross-currents.