Why Leading Companies Launch Ventures — and the Six Success Factors

Corporate Ventures have been successfully used by many corporations to drive growth through innovation while mitigating risk. How are they doing it?

Why late adopters risk falling behind!

1. Corporate Venture Capital (CVC) share of Global VC$ has risen from 22% to 28% over 2019-24. There is demonstrable momentum as shown by the chart below.

*Deal value = CVC‑participating rounds (CB Insights + GCV analytics).

2. The momentum is driven by data showing successes:

Mature CVC funds average ~25 % IRR, outpacing traditional VC (~20 %).

Start‑ups with corporate backing show 2× survival and higher exit valuations than VC‑only peers.

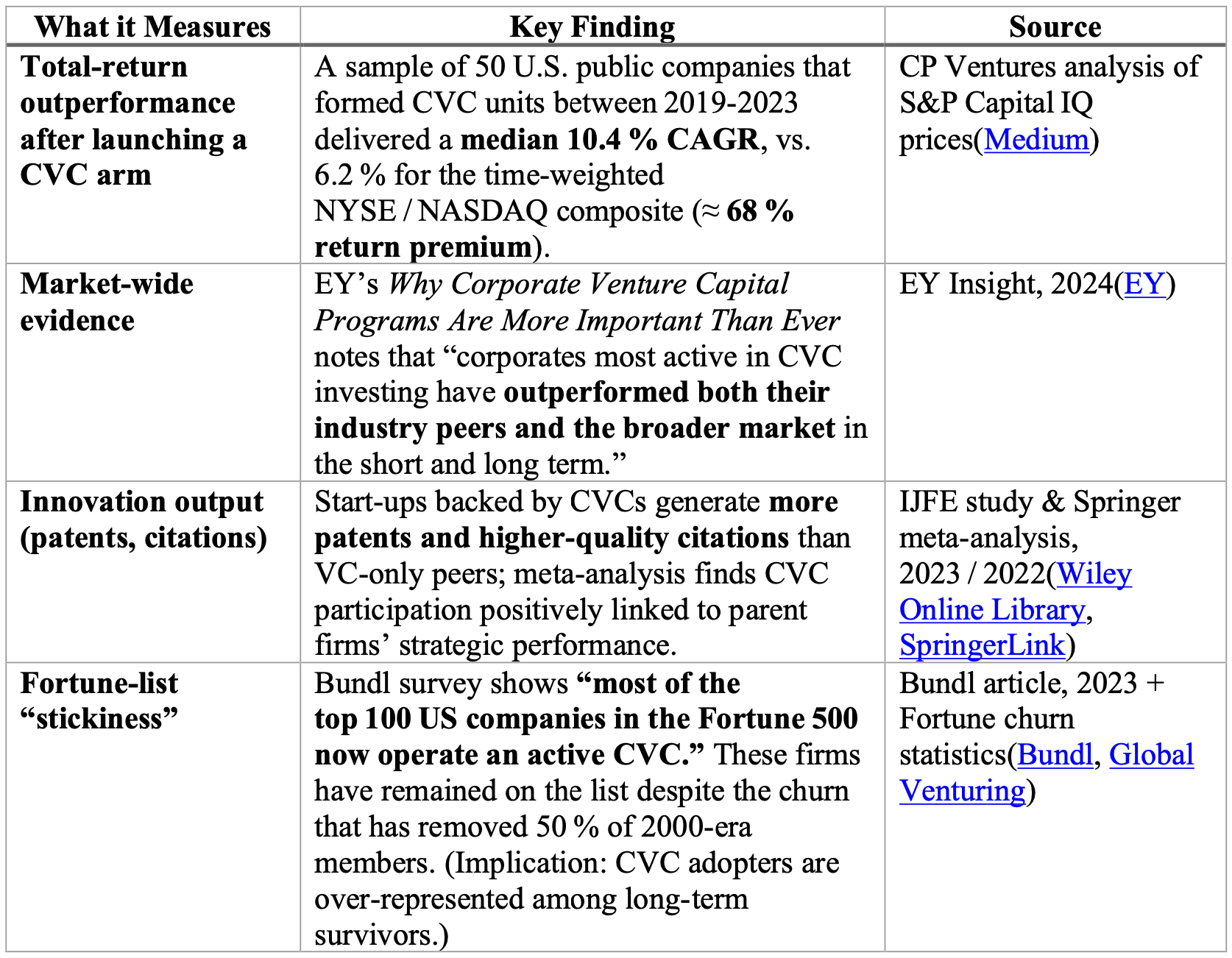

Public companies running CVCs outperform non‑CVC peers by68% on stock returns(see table below) and outperform on innovation metrics and Fortune‑rank stickiness.

3. Successful Corporate Ventures show Six 𝐊𝐞𝐲 𝐒𝐮𝐜𝐜𝐞𝐬𝐬 𝐅𝐚𝐜𝐭𝐨𝐫𝐬

In our work guiding industrial and tech leaders, six hard-won factors matter most in addition to a solid business plan and sustainable competitive advantage.

𝐈𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐭 𝐠𝐨𝐯𝐞𝐫𝐧𝐚𝐧𝐜𝐞 & 𝐜𝐥𝐞𝐚𝐫 𝐊𝐏𝐈𝐬: Think AWS ... full P&L, autonomy, internal accountability.

𝐄𝐧𝐭𝐫𝐞𝐩𝐫𝐞𝐧𝐞𝐮𝐫𝐢𝐚𝐥 𝐥𝐞𝐚𝐝𝐞𝐫𝐬𝐡𝐢𝐩 𝐰𝐢𝐭𝐡 𝐚𝐥𝐢𝐠𝐧𝐞𝐝 𝐢𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬: Google X, a semi- autonomous innovation lab, allowed intrapreneurs to chase moonshots with equity style rewards.

𝐑𝐞𝐥𝐞𝐧𝐭𝐥𝐞𝐬𝐬 𝐜𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐟𝐨𝐜𝐮𝐬 + 𝐥𝐞𝐚𝐫𝐧 𝐟𝐚𝐬𝐭 𝐥𝐨𝐨𝐩𝐬: TurboTax Live matured through Intuit’s Labs style rapid experimentation with real customers.

𝐅𝐚𝐢𝐥𝐮𝐫𝐞 𝐚𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 & 𝐭𝐚𝐥𝐞𝐧𝐭 𝐬𝐚𝐟𝐞𝐭𝐲 𝐧𝐞𝐭: Microsoft absorbed $4 B+ in early Xbox losses yet retained key engineers and doubled down to launch Xbox 360.

𝐎𝐩𝐞𝐧 𝐢𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧 & 𝐯𝐞𝐧𝐭𝐮𝐫𝐞-𝐜𝐥𝐢𝐞𝐧𝐭 𝐦𝐨𝐝𝐞𝐥𝐬: BMW Startup Garage piloted fast with external founders.

𝐒𝐜𝐚𝐥𝐞 𝐚𝐝𝐯𝐚𝐧𝐭𝐚𝐠𝐞𝐬 𝐭𝐡𝐚𝐭 𝐫𝐞𝐚𝐥𝐥𝐲 𝐡𝐞𝐥𝐩: Apple Silicon leveraged the mother ship’s scale to support differentiated ventures.

𝐌𝐢𝐝-𝐜𝐚𝐩𝐬 𝐜𝐚𝐧 𝐚𝐩𝐩𝐥𝐲 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞 𝐩𝐥𝐚𝐲𝐛𝐨𝐨𝐤 𝐨𝐧 𝐥𝐞𝐚𝐧𝐞𝐫 𝐛𝐮𝐝𝐠𝐞𝐭𝐬: spin-out governance, milestone incentives, and a fast pilot lab. It can set you apart from your average peers.

4. How Chapel Hill Advisors can help

We have stood up and pruned venture portfolios inside Fortune 500 industrials. Our role:

Facilitate monthly go/no-go meetings; ask the hard (but respectful) questions

Coach teams and help them prepare for go/no-go meetings

Design governance and incentive models that survive leadership transitions

Innovation is a key part of growth. Corporate Ventures are enabling growth by leveraging VC capital, experimenting with mitigated risk, and inspiring intrapreneurs. If you haven’t tried this, you are likely falling behind competitors who are moving forward.

Ready to attack white-space growth through CVCs? Let’s talk.

Note: All statistics in this article are drawn from publicly available research (Global Corporate Venturing, CB Insights, EY, HBR, etc.). Past performance is not a guarantee of future results. This article is for informational purposes only and does not constitute investment advice.

Sources:

• CB Insights + Global Corporate Venturing (GCV) Analytics, 2024

• EY Insight: Why Corporate Venture Capital Programs Are More Important Than Ever, 2024 • S&P Capital IQ / CP Ventures Analysis (2023) via Medium

• International Journal of Finance and Economics (IJFE), 2023

• SpringerLink Meta-analysis, 2022

• Harvard Business Review: Corporate VC’s Rise

• Bundl, 2023: CVC Trends Among Fortune 100 Firms

• Global Corporate Venturing: Fortune list churn data and innovation benchmarks

• SVB 2024 State of CVC Report